China reduced its dollar holdings in February

More on:

It is a good thing the US trade deficit has come down, because foreign demand for US financial assets -- actually foreign demand for US assets other than short-term Treasury bills -- has dried up.

Foreign investors bought $68 billion of T-bills in February. Russia alone (likely Russia’s central bank) bought close to $14 billion. Private investors -- seemingly Japanese private investors -- also bought $23.5b of longer-term Treasury notes. Otherwise, though, foreign investors didn’t buy much of anything. And Americans also didn’t buy many foreign assets.*

After Keith Bradsher’s New York Times article, though, all eyes are on China.

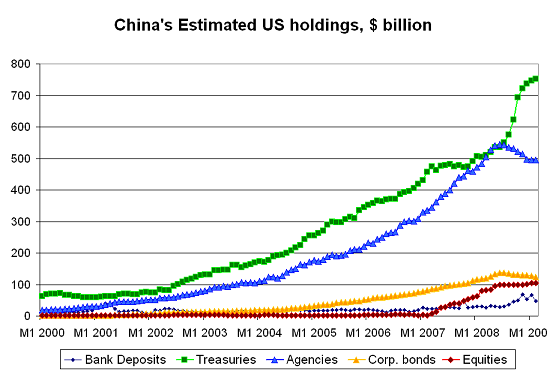

In February, China bought Treasuries. $4.64b by my count. It bought $5.61b of bills, while reducing its long-term Treasury holdings by $0.96 billion.

But China also reduced its US bank deposits by $17.24 billion.

Consequently, by my count, China’s total US holdings fell by $13 billion. Short-term claims fell by $11.3b, and long-term claims fell by $2b. The data on China’s short-term claims can be found here.

Is this the beginning of the end? Has China decided to stop buying US assets?

In my view, no.

China’s trade surplus was particularly low in February (largely for seasonal reasons), so less money was coming in. And if January’s purchases are added to February’s sales, China’s US holdings are still up -- though only by $7-$8 billion.

More importantly, one month does not a trend make.

Over the past several months, China clearly has been shifting out of Agencies toward Treasuries -- and buying fewer "risky" US assets of all kinds. It also clearly has been shifting its Treasury portfolio toward short-term bills.

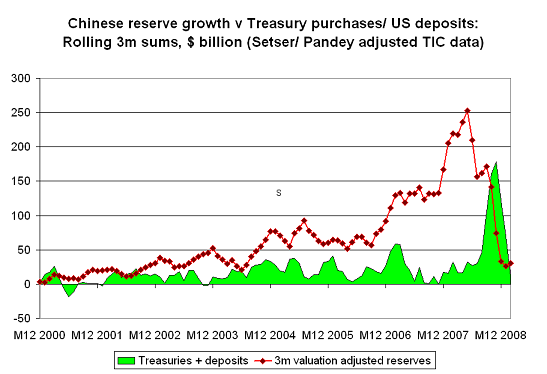

But until February, China’s recorded dollar purchases, best I could tell, exceeded the growth in China’s reserves. China’s flows into "safe" US assets certainly exceeded its reserve growth.

I didn’t want to say that China was shifting into the dollar in November and December,** and I similarly don’t want to say that China is shifting out of the dollar now.

What is clear is that the slowdown in China’s reserve growth has started to translate -- as expected -- into a slowdown in China’s direct purchases of US assets.

Over the last three months, for the first time in a long time, the Setser/ Pandey data set -- which includes an estimate of Chinese purchases through London -- didn’t show any rise in China’s foreign assets.***

China’s estimated US portfolio has been hovering between $1520 and $1540 billion since November.

If China’s reserve growth picks up and China’s US holdings don’t that would be a real change. But for now, the story seems to be that the slowdown in China’s reserve growth has translated into a slowdown in its US purchases.

* The big swing in total TIC flows comes from the line item showing the net change in banks own dollar-denominated liabilities. I don’t have a full explanation for the large outflows in January and February (a combined $250b or so). They seem to be the counterpart though to the $635b in inflows from this line item last fall (from September to December). If I had to guess, I would bet both the inflow in the fall and the current outflow are linked to the Fed’s swap lines with foreign central banks -- and the associated rise in European central banks dollar loans to European commercial banks. The rise in the fall corresponds with the expansion of the Fed’s swap lines in the fall, as the world’s central banks cooperated to provide a "global" dollar lender of last resort. And the recent outflow seems to correspond with the repayment of the Fed’s swap lines. Just a guess though. Confirmation would be appreciated.

** Some of the inflow into US assets could have come as China shed offshore dollar assets, or as China pulled dollars from private intermediaries.

*** China’s equity holdings have not been marked to market; the chart consequently overstates the current market value of China’s US equity holdings. I haven’t adjusted China’s equity portfolio because I suspect SAFE holds its equities on its books at their purchase price -- i.e. it also doesn’t mark to market. Plus the spreadsheet was designed for bonds and I haven’t added a mark to market function!

More on:

Online Store

Online Store