- RealEcon

- Israel-Hamas

-

Topics

FeaturedInternational efforts, such as the Paris Agreement, aim to reduce greenhouse gas emissions. But experts say countries aren’t doing enough to limit dangerous global warming.

-

Regions

FeaturedIntroduction Throughout its decades of independence, Myanmar has struggled with military rule, civil war, poor governance, and widespread poverty. A military coup in February 2021 dashed hopes for…

Backgrounder by Lindsay Maizland January 31, 2022

-

Explainers

FeaturedThis interactive examines how nationwide bans on menthol cigarettes and flavored cigars, as proposed by the Biden administration on April 28, 2022, could help shrink the racial gap on U.S. lung cancer death rates.

Interactive by Olivia Angelino, Thomas J. Bollyky, Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

-

Research & Analysis

FeaturedFollowing a long series of catastrophic misadventures in the Middle East over the last two decades, the American foreign policy community has tried to understand what went wrong. After weighing the e…

Book by Steven A. Cook June 3, 2024

-

Communities

Featured

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023

-

Events

FeaturedJohn Kerry discusses his work as U.S. special presidential envoy for climate, the challenges the United States faces, and the Biden administration’s priorities as it continues to address climate change.

Virtual Event with John F. Kerry and Michael Froman March 1, 2024

- Related Sites

- More

Blogs

Follow the Money

Latest Post

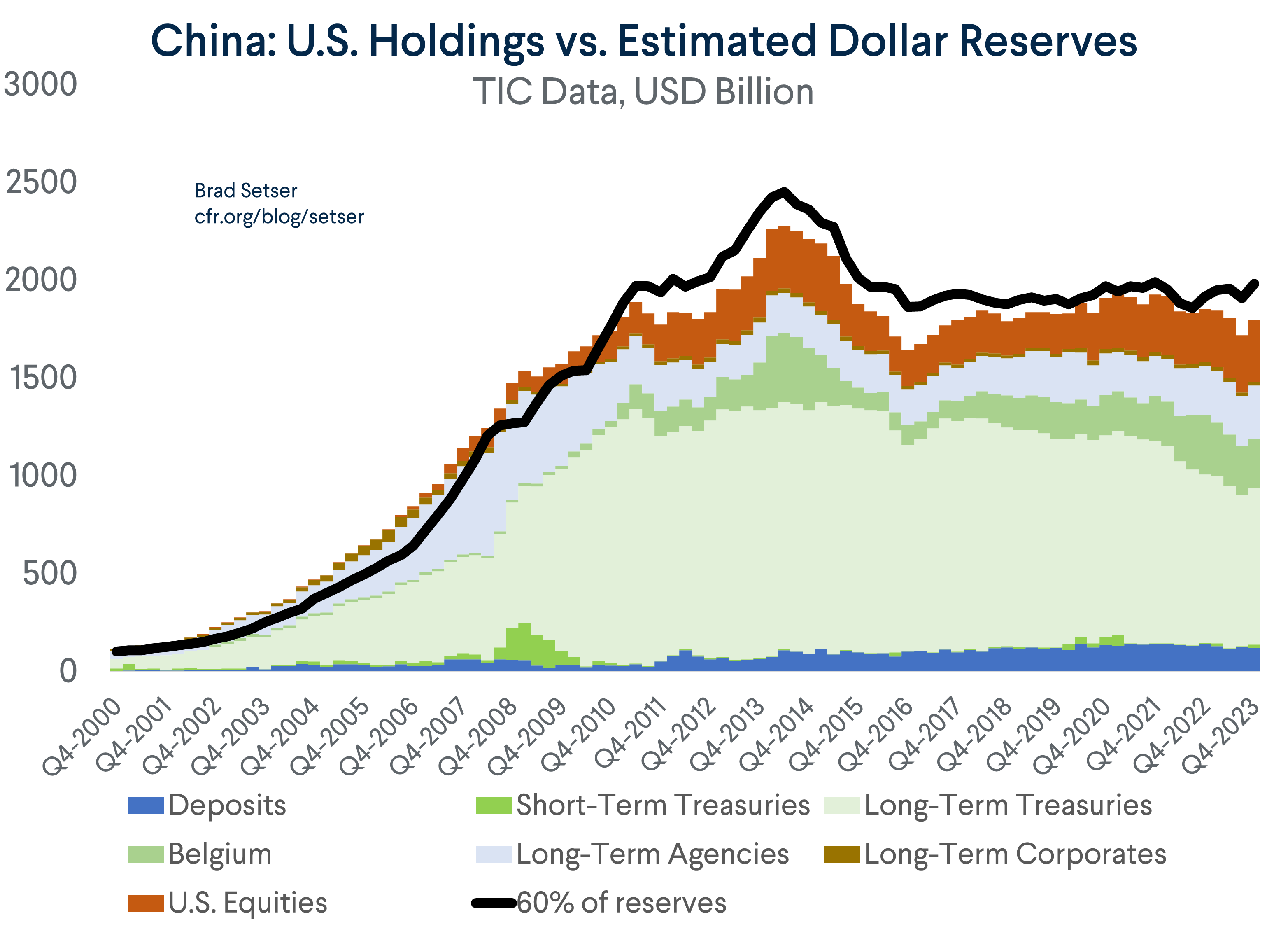

Power and Financial Interdependence

My new paper for the Geoeconomics and Geofinance Initiative of the Institute Français des Relations Internationals’ (IFRI) explores the history of the Sino-American financial relationship. Read More

It Is Time To Scrap the IMF's Reserve Adequacy Metric

The IMF reserve metric isn't working: it is failing to differentiate between obviously under-reserved countries like Turkey and Argentina and adequately reserved countries like China.

The Changing Nature of Turkey’s Balance Sheet Risks

Pay attention to banking system's foreign currency exposure to the government ...

China’s Surplus is Rising Rapidly. So is the U.S. Deficit. The IMF Cannot Turn a Blind Eye.

Do not use the IMF’s current account forecast in the Fall 2020 World Economic Outlook (WEO). It is already out of date.

Reframing the Collective Action Problem in Sovereign Bond Restructuring

A recent white paper from Lazard points out that emerging market sovereign bond holdings are often fairly concentrated among a handful of big players. The main impediment to collective action may be less that bond holders are dispersed, and more that a handful of big holders all compete against each other and the benchmark.

Record Chinese Bilateral Surpluses With the United States Are Not Mirrored in the U.S. Trade Data

Is China’s surplus with the United States back at a record level? It depends. In China’s data, China’s exports to the United States and its surplus with the United States are at all-time highs. The United States’ import data, however, shows fewer imports from China than China reports exports—which is interesting, because the norm has long been the other way around.

Online Store

Online Store