Women on the Blockchain: Moving Beyond “Blockchain Bros”

This blog post is coauthored by Rebecca Hughes, a research associate with the Women and Foreign Policy program at the Council on Foreign Relations.

Blockchain expert Amber Baldet, the cofounder and CEO of Clovyr, recently joined Adjunct Senior Fellow Catherine Powell for a roundtable on “Women Revolutionizing Blockchain: Cryptocurrencies for Change.” Clovyr helps traditional businesses utlize blockchain-based technologies. During the discussion, Powell and Baldet explored gender dimensions of blockchain and cryptocurrencies—in particular they discussed opportunities for women as users and barriers to women’s participation as innovators.

More on:

Though blockchain has been declared the “next big thing,” the technologies that underlie it are not new. But the way they are being used is revolutionary. Blockchain is a digital ledger – distributed over a network of computers – that enables parties to interact without the need for a central authority to validate those transactions. Blockchain is unique in that it not only facilitates the transmission of data around a network, but also enables the transmission of value, such as through its application as cryptocurrency. Cryptocurrencies are digital assets, secured through encryption, and registered on a public blockchain. Bitcoin, the most well-known cryptocurrency, catapulted blockchain into the public eye circa 2010.

Cryptocurrencies for Change

Cryptocurrencies have the potential to radically alter how financial systems are structured, which would have significant effects on women worldwide. Specifically, cryptocurrency could provide women with financial tools to start businesses, purchase property, and save money. This could be particularly important in countries and communities where women face legal and social restrictions to financial inclusion.

Despite an additional 1.2 billion people joining financial institutions over the past seven years, women are still less likely than men to own bank accounts. According to the World Bank, 56 percent of all unbanked adults are women. Bank accounts enable owners to transfer and save money, build financial resilience, and invest in business and educational opportunities. But for many people the cost of opening an account is prohibitive—according to the 2017 Global Findex database, about 25 percent of unbanked adults cite cost as a reason they do not have an account.

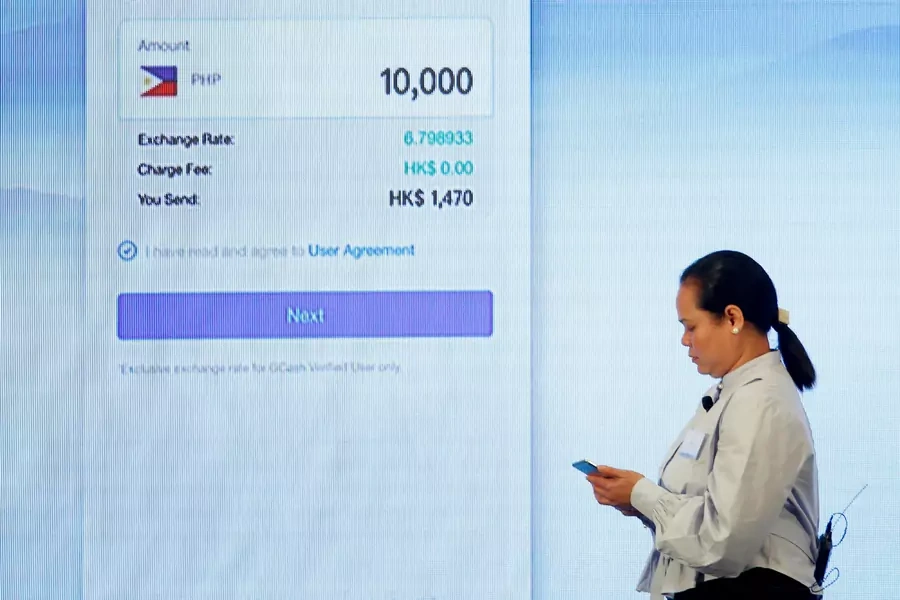

Cryptocurrencies could make financial systems and institutions less costly and more efficient and inclusive. While traditional monetary and electronic payment systems depend on intermediaries—such as central banks and private financial institutions—to validate transactions, cryptocurrencies “cut out the middle man.” Instead, users transfer digital money to one another through blockchain-enabled protocols. Without the need for intermediaries or the infrastructure required to support them, blockchain supporters hope that the adoption of cryptocurrencies will reduce costs, increase efficiencies, and expand opportunities for women and other unbanked populations to participate in financial systems.

Cryptocurrencies could also increase women’s participation in financial systems by increasing transparency and trust. The overwhelming bulk of the world’s unbanked adults—most of whom are women—live in developing countries where distrust is commonly cited as a reason for not having a bank account. However, with cryptocurrencies, transactions are recorded in a public digital ledger and validated by all participants, instead of by a potentially untrusted central authority. At the same time, participants benefit from a degree of privacy, since only individuals who are parties to the chain of transactions have access to the series of exchanges. This privacy can assist women to participate in financial transactions, free from interference from those who might otherwise restrict their participation.

More on:

Drawing on Shoshana Zuboff’s notion of “surveillance capitalism,” Baldet also spoke about the potential value of blockchain more broadly as a vehicle or providing more privacy in sharing data and other valuable information. Of course, an outstanding concern is how to enable such social benefits, without also facilitating illegal transactions, such as trafficking and money laundering.

“Blockchain Bros”

But will cryptocurrencies live up to their potential to advance equality and opportunity? As one of us has explored before, advocates for blockchain technologies – who note that it could facilitate social good – are nevertheless troubled by the lack of diversity in the blockchain community. Blockchain conferences and panels consistently fail to include women as speakers. During one conference, organizers held a networking event in a strip club that they had rented out. This culture caters to an emerging class of “blockchain bros” and an environment that many women find hostile and disappointing. According to some studies, women account for only 4 to 6 percent of blockchain investors. And women aren’t the only ones being left out—the blockchain community mirrors the tech world in that people of color are also vastly underrepresented.

What Does the Future Hold?

Some have hailed the arrival of blockchain as a panacea, which will solve everything from the healthcare system to supply chain transparency. Blockchain certainly holds the potential to provide a form of leapfrog technology for women in developing countries. For example, Facebook claims that Libra, the cryptocurrency it is developing, will assist in “banking the poor” and extending financial services to those in remote areas, and beyond the reach of traditional banking services.

But in reality, blockchain is just like any other new technology—its applications will only be as diverse and innovative as its creators. Unless blockchain developers address the diversity problem, these promising new technologies risk benefiting only a select few, and entrenching, rather than upending, inequality.

Online Store

Online Store