Why NGDP Targeting is a Fad

More on:

Big-name economists have been lining up to show their support for yet another target-based approach to monetary policy making: nominal gross domestic product level (NGDP) targeting. The basic idea is that a central bank should aim to stabilize GDP, unadjusted for inflation, at around 4.5% as a means of stabilizing aggregate demand and avoiding recessions. NGDP targeting having once been the intellectual stomping ground of economists on the right (notably Scott Sumner), its newest supporters come overwhelmingly from the left (such as Christy Romer).

After the collapse of Bretton Woods in the 1970s, targeting of the money supply became the monetary Holy Grail. In the 1990s, as money supply targeting became operationally too problematic, the world shifted to the targeting of consumer price inflation. But after 2008, when July U.S. CPI hit 5.6% in the midst of a financial crisis, support for inflation targeting – which had become as close to global monetary orthodoxy as the gold standard had been in the late 19th century – melted away. Credible justification was needed for loosening policy at a time of elevated inflation. A year later, with CPI at -2.1%, such justification was no longer necessary. But those fearing a too-early tightening in policy turned to other targets. Targeting the price level, rather than price inflation, became popular, as it required the Fed to tolerate more inflation in the future to compensate for deflation and under-inflation in the past. The Fed itself has now turned to a temporary unemployment-level target. But NGDP targeting is truly the new intellectual rage. New Bank of England governor Mark Carney is the most prominent advocate in policy-making circles.

We think the rage will be short-lived. The reason is that NGDP targeting’s newest supporters are bad-weather fans. That is, they like it now, when NGDP is well below its 2007 “trend” line, meaning that the policy implies extended and more aggressive monetary loosening. But what happens when NGDP goes above its target, as it eventually will? NGDP targeting then requires tightening, even if inflation is low – it may even require a deliberately deflationary policy stance.

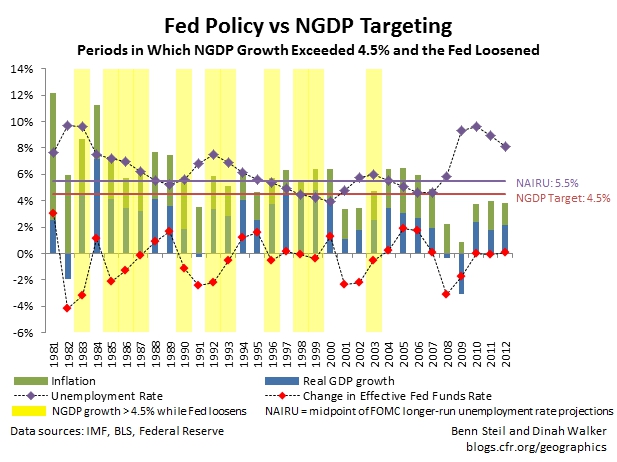

In this week’s Geo-Graphic, we identify in yellow 11 periods between 1983 and 2003 when the Fed was loosening policy but where a 4.5% NGDP target would have prescribed tightening.* This suggests strongly that NGDP targeting has no legs: when it tells the Fed to tighten, its prominent new supporters will abandon it even more quickly than they embraced it. Indeed, two noted monetary economists have even called pre-emptively for the abandonment of NGDP targeting once it’s done its job of justifying looser policy today. “Once the nominal GDP growth shortfall has been eliminated,” Michael Woodford and Frederic Mishkin wrote in the Wall Street Journal on January 6, “ it will be appropriate to again conduct policy much as was done before the crisis.” Yet since the rationale behind both inflation targeting and NGDP targeting is that they anchor public expectations for the long-term, adopting them opportunistically is a particularly bad idea.

* We look at the annual rate of NGDP growth, rather than NGDP levels—using levels would suggest continuous tightening throughout the period and many more yellow bars.

Romer: Dear Ben: It’s Time for Your Volcker Moment

Steil: The Battle of Bretton Woods

Mishkin and Woodford: In Defense of the Fed's New Interest-Rate Policy

More on:

Online Store

Online Store