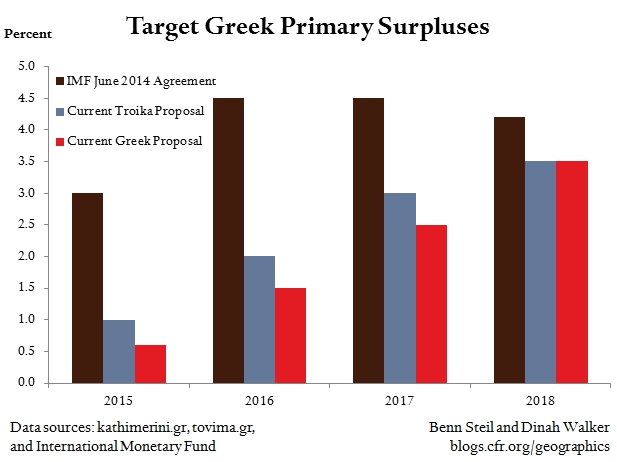

Greece-Troika Gap Over Primary Surpluses Has Shrunk Dramatically

More on:

Greece has announced that it will not pay the IMF the €300 million due to the Fund on June 5. Instead, it will “bundle” the payments due to the Fund over the course of June into one payment of about €1.7 billion that it will make at the end of the month. This contradicts earlier pledges that it would not resort to bundling. The only country ever to have done so is Zambia, three decades ago.

While the dramatic move suggests that Athens is seriously contemplating outright default, we think such a move, at this point, borders on insanity. This is because the gap between the parties over the main issue between them, the size of the primary budget surplus (the excess of revenues over expenditures, excluding interest payments) Greece will have to achieve in the coming years is now very small relative to what it was a year ago - as shown in the figure above. In contrast, the cost of a Greek default is likely to be a complete cut-off in ECB liquidity support that will crush the Greek banking system and, also likely, force the country out of the Eurozone.

Then again, Greece has always had an affinity for tragedies.

Follow Benn on Twitter: @BennSteil

Follow Geo-Graphics on Twitter: @CFR_GeoGraphics

Read about Benn’s latest award-winning book, The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order, which the Financial Times has called “a triumph of economic and diplomatic history.”

More on:

Online Store

Online Store