“Battling for Yellen’s soul” is how Bloomberg described recent statements by Board members Stanley Fischer and Lael Brainard. Fischer has emphasized upside risks to inflation, Brainard downside risks.

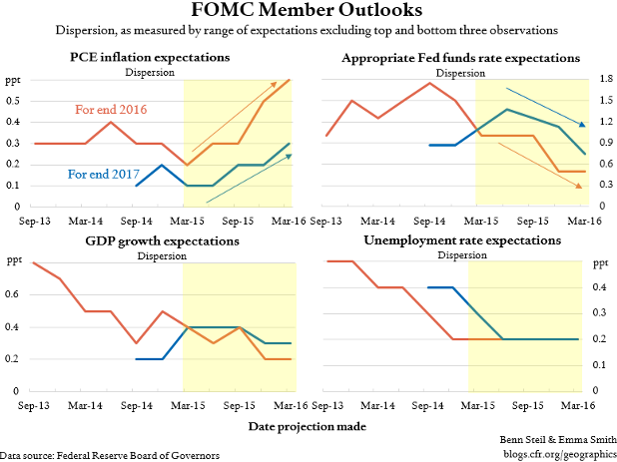

As our top left figure shows, this divergence of perspectives is hardly limited to Fischer and Brainard. We find that the dispersion of views on the likely path of inflation within the FOMC has widened dramatically since the beginning of 2015.

More on:

What is fascinating in this context is that this divergence is not mirrored in their assessments of the appropriate path for the Fed funds rate. As shown in the right-hand figure, there has been an equally dramatic convergence on rate policy.

How to explain this?

Although the media has spotlighted the inflation debate, the Fed appears to be focused on the second part of its mandate—which it broadly interprets as maximum sustainable employment and growth. As our bottom figures show, views within the FOMC on the paths of these two variables have converged—in line with their views on appropriate rates.

In short, if the presidential race is, in James Carville’s famous words, about “the economy, stupid,” within the Fed the economy is currently about employment and growth—not inflation.

More on:

Online Store

Online Store