China’s WTO Entry, 15 Years On

Late last year Tim Duy asked for an assessment of the decision to allow China to join the WTO, now that 15 years have passed.

Greg Ip met the call well before I did, in a remarkable essay.

More on:

But I will give my own two cents. Be warned, this isn’t a short post. Frankly it is an article disguised as a post. I added the subheadings to make it a bit easier on the eye.

Autor, Dorn, and Hanson Deserve All the Attention They Have Received

It now seems clear that the magnitude of the post-WTO China shock to manufacturing was significantly larger than was expected at the time of China’s entry into the WTO. China already had “most-favored-nation” (MFN)/“normal trade” access to the U.S. market, so it wasn’t clear that all that much would change with China’s WTO accession. But China’s pre-WTO access to the U.S. came with an annual Congressional review, and the resulting uncertainty seems to have deterred some firms from moving production to China.

The domestic labor market adjustment to the “China” shock was not smooth. Autor, Dorn, and Hanson’s research shows the China shock left a significant number of Americans temporarily without jobs and left some workers and communities permanently worse off. The U.S. labor market isn’t as homogenous or as flexible as many thought; displaced workers in the most exposed regions often dropped out of the work force rather than finding new, let alone better, jobs.

Similar effects to those that Autor, Dorn, and Hanson found in the U.S. also seem to be present in manufacturing intensive parts of a number of European countries (France, for example). Bob Davis and the Wall Street Journal also deserve credit for their reporting on this topic: Davis and his colleagues really helped flesh out the narrative that goes with the Autor, Dorn, and Hanson data.

Not All China—The Underreported Impact of Dollar Strength (2000-2002)

All that said, the shock from the rise in imports that came with China’s WTO entry was not the only source of the enormous decline in manufacturing jobs between 2000 and 2005.

More on:

The broad strength of the dollar from 2000 to 2002 mattered.

The late 1990s were actually pretty good years for U.S. manufacturing even with a relatively strong dollar. In the late 1990s the strong dollar came hand-in-hand with a surge in domestic U.S. demand for American-made as well as global manufactures. The data superhighways of the 1990s were often built with U.S. made equipment. The booming stock market—and low oil prices in the 1990s—created demand for “big” U.S. made SUVs. However, the strength of the dollar weighed on the U.S. economy after U.S. demand for capital goods collapsed. In the aftermath of the dot-com era and the collapse in domestic demand for capital goods, the U.S. needed to turn to exports to have a healthy economy—and from 2001 to 2003 exports fell along with domestic demand, leading a lot of manufacturing capacity to leave the U.S.

With the benefit of hindsight, I sort of think that Treasury Secretary Paul O’Neill should have rented out Yankee Stadium to announce a shift in dollar policy back then.

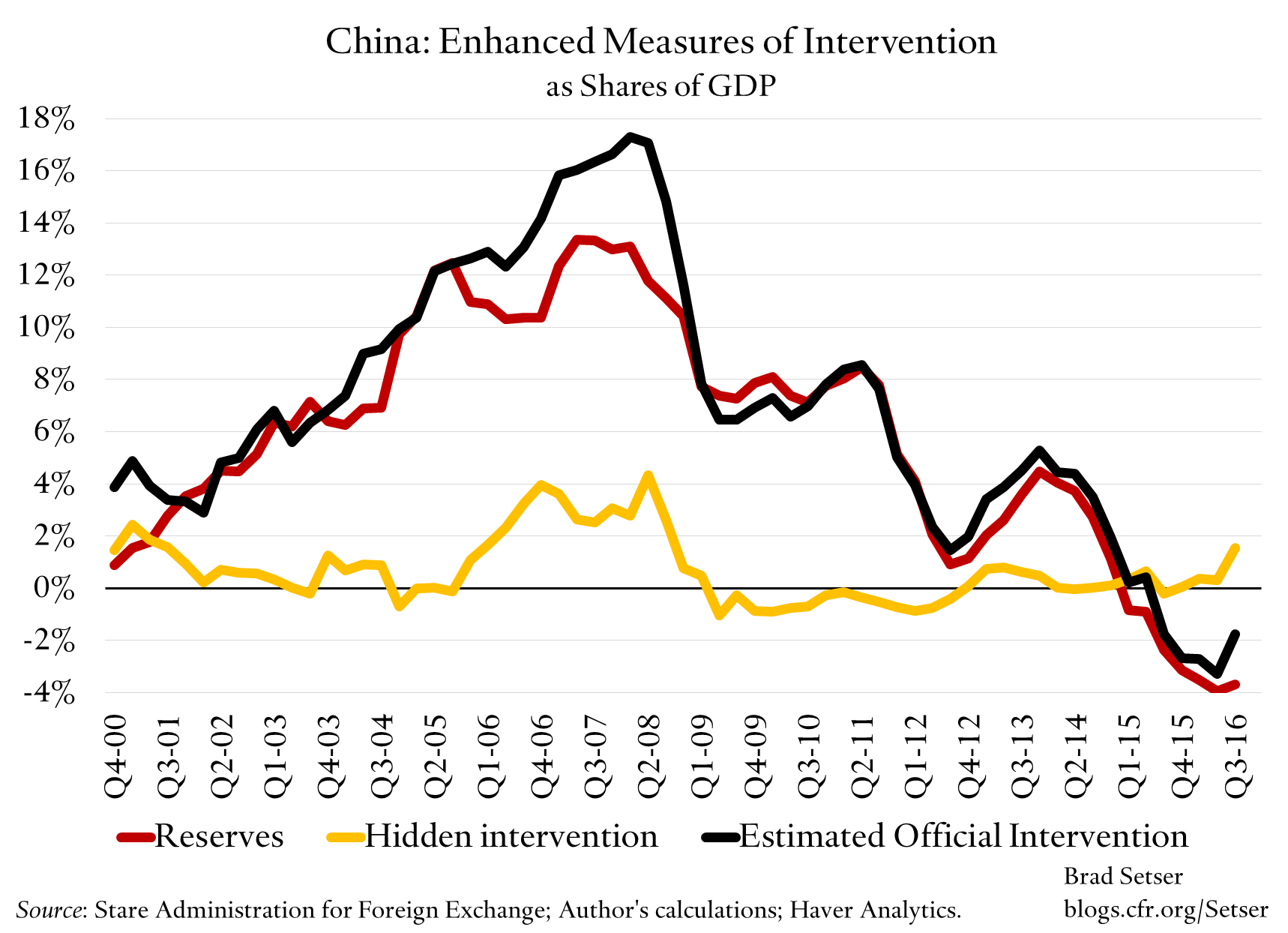

The dollar bubble burst in 2003. But the dollar only fell against the euro and some other major currencies. It didn’t fall against China, or fall by much against many Asian currencies. 2003 is really when China and others started intervening on an unprecedented scale to keep their currencies undervalued. China was hardly adding to its reserves at all when it joined the WTO. At the time, annual reserve growth, using my best estimates which attempt to count all hidden or shadow intervention, was 2-3 percent of China’s GDP. By 2006 it was ten percent of China’s GDP (counting hidden intervention through the banks); by 2007 it was 15 percent of China’s GDP (counting a new form of hidden intervention through the state banks). Based on the work of Joe Gagnon of Peterson Institute and his co-authors, I think that China’s intervention from 2003 to 2008 added between 3 and 6 percentage points to its current account surplus (I could argue for a higher number, actually—see the footnotes here). The market wasn’t allowed to work for a long time—China’s exchange rate didn’t really start to appreciate in a way that would push firms to reconsider their production structure until late 2007.

By then much of the damage had been done. There seems to be a bit of path determinacy in the location of production decisions (to be fancy, hysteresis). Once industries and supply chains move to low-cost emerging economies, they have tended to stay put. Moving final assembly of electronic goods to Asia created pressures for the full supply chain to move to Asia, as Bradsher and Duhigg documented back in 2012.

WTO Accession Didn’t Make China an Easy Market for Other Countries’ Exports

Even if the currency issue is taken off the table, I suspect that the trade gains—or really the export gains— from integrating China into the WTO’s “rules” were overestimated.

It is now clear that WTO accession was not enough to make China into an easy market for foreign firms to supply from outside China.

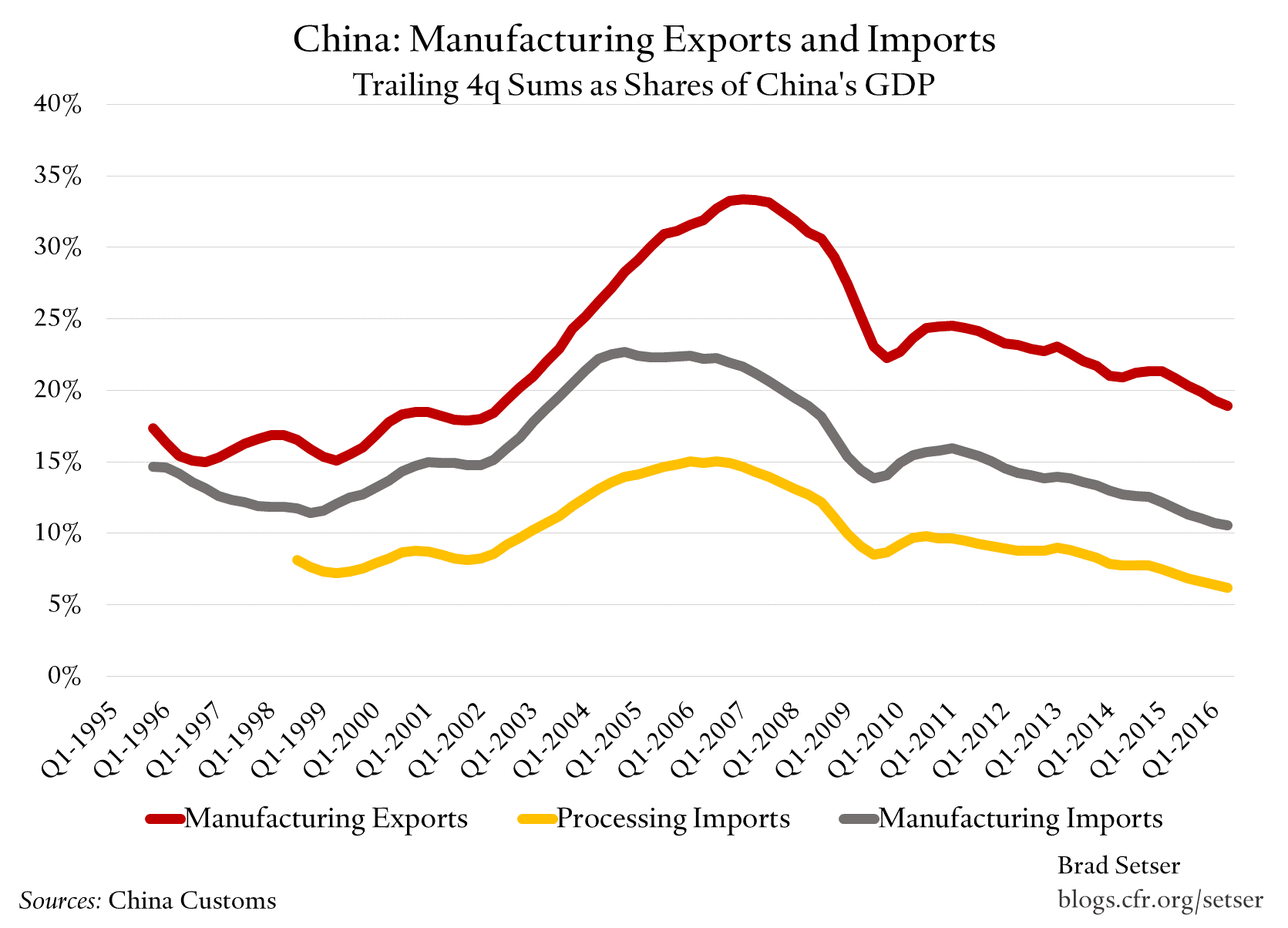

Here is a point that I think should get a bit more emphasis. China’s imports of manufactures, net of its imports of imported components, peaked as a share of Chinese GDP in 2003—and have fallen steadily since then. There is no “WTO” effect on China’s imports of manufactures, properly measured (i.e. leaving out imports for re-export). Chinese imports of manufactures for China’s own use are now under 5 percent of China’s GDP—a low number compared to China’s peers. As a result, right now, China supplies roughly three times as many manufactures to the world as it buys for its own use (net of processing imports, manufactured exports around 12.5 percent of China’s GDP; net of processing imports, manufactured imports are around 4.5 percent of China’s GDP, for a manufacturing surplus of around 8 percent of China’s GDP).

Back in 2000 and 2001, China was expected to do well in the production of apparel and low-end consumer goods. But it was also expected to be a big market for a wide range of sophisticated U.S. and European capital goods. Broadly speaking that hasn’t been the case, setting aircraft aside. Some firms have succeeded in China, but generally by producing in China for the Chinese market, not by selling to China. Successful challenges to some specific Chinese practices in the WTO have yet to alter this pattern.

Mark Wu’s excellent article offers a plausible explanation for why. The WTO rules aren’t all that constraining in a country like China—thanks to state control of commanding heights enterprises and banks, and institutions, such as the National Development and Reform Commission (NRDC), that assure party control of major state firms and large investment projects.

Let me be concrete, and offer a few examples.

McKinsey’s 2016 China outlook notes that Chinese firms are now among the world leaders in wind turbines and high speed rail: “[China has the] potential to carve out a world-leading position in pharmaceuticals, semiconductors, and communications equipment in the way that it has done in high-speed rail and wind turbines.”

Yet China’s success in rail and wind wasn’t exactly a product of the magic of the market.

The Chinese used the purchasing power of the railway ministry to encourage foreign firms to form joint ventures with Chinese firms to develop China’s high speed rail infrastructure, and over time the foreign technology was “digested” by Chinese firms. And in wind power, equipment from Chinese companies got preference in the bidding for large wind farms to supply the state controlled power grid (even if sometimes the grid hasn’t always figured out how to make use of resulting energy supply, at least not yet).*

The state’s hand was clear, but not in ways that were obviously forbidden by the WTO. Or at least not in ways that have been successfully challenged in the WTO. Firms’ investment decisions aren’t technically government procurement if the investment is for the provision of a commercial service, and the state’s guidance isn’t always written down. Yet even today the preferences provided for local firms in strategic sectors, like medical equipment, aren’t exactly a secret that China tries all that hard to hide. McKinsey again: "Mindray, United Imaging Healthcare, and other smaller new Chinese players will continue to make inroads in market categories (for instance, CT scanners and MRI machines) that foreign suppliers now dominate. Government programs to subsidize purchases of Chinese-made equipment by the country’s hospitals are providing a boost…"

There are a few important sectors where Chinese demand isn’t met locally: notably aircraft (though China has plans for import substitution there) and high-end autos. But not nearly as many as would be needed for trade with China to be reasonably balanced, given China’s dominance in electronics manufacturing—and its increasing powers across a range of “engineering” sectors.

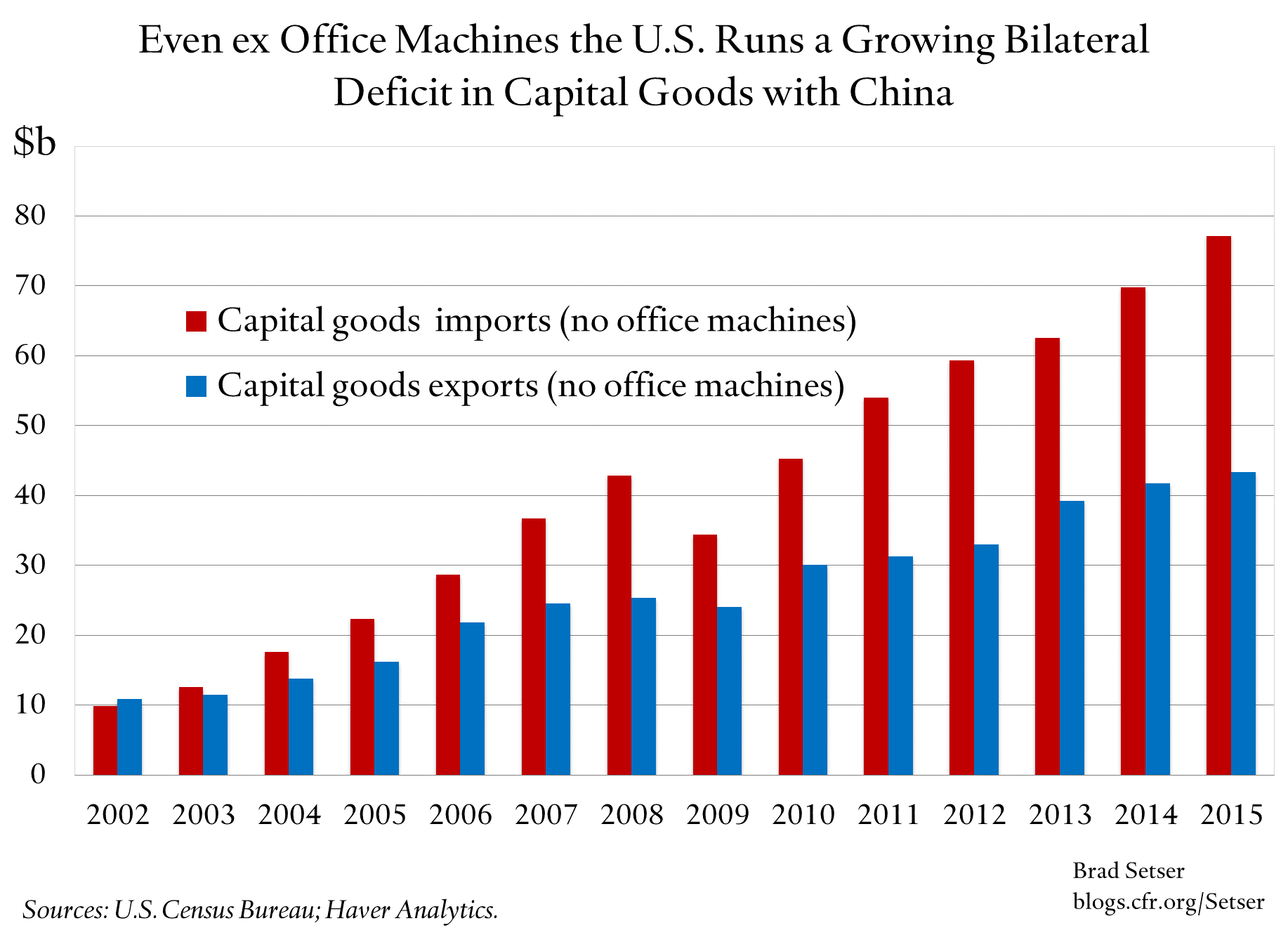

The U.S. for example, runs a significant trade deficit in capital goods with China (even after taking out computers). That wasn’t the expectation back in 2001.

As an aside—I fully recognize that China naturally will run a surplus in manufactures and import primary products/commodities: looking at manufacturing in isolation is a very partial analysis. Chinese demand for commodities did deliver large positive spillovers to commodity producers globally, even as higher commodity prices squeezed the real incomes of a lot of commodity consumers globally.

Agreed Safeguards Against Import Surges Were Under-Used

In the face of a China that didn’t deliver the expected market for manufactured exports from the advanced economies—and in the face of foreign exchange market intervention that reached 10 to 15 percent of China’s GDP in the period that immediately preceded the crisis—the U.S. and Europe remained relatively open to Chinese imports.

Mark Wu argues, correctly, that the WTO accession agreement provided a set of provisions that were designed to help manage the risks associated with China’s integration: the “non-market economy” provision, which made it easier for U.S. firms to bring dumping cases against China; and the “special safeguards” provision, which lowered the standard required for imposing temporary tariffs against a surge in imports from China for the twelve years after China’s WTO accession.

The non-market economy provision was certainly used, notably by the steel industry.

The special safeguards provision (section 421) wasn’t used much at all.

In no small part, this is because U.S. and European firms benefited from making use of Chinese production to meet global demand. The interests of U.S. firms and U.S. labor were not always aligned.

But 421 safeguards also were not used because the remedy if a function of discretionary decisions made by the executive branch, and the Bush 43 administration made it clear it wasn’t going to hand out safeguards easily. Robert Lighthizer, back in 2010:

“Between 2002 and 2005, the U.S. International Trade Commission ("ITC") heard four cases in which it determined that the requirements for a China-specific safeguard had been met. In every case, however, the Bush Administration exercised its discretion to deny relief – effectively rendering Section 421 a dead letter. Indeed, after 2005 U.S. companies stopped even applying for safeguard measures from the Bush Administration. Thus, for much of the time that Section 421 was supposed to be available to U.S. companies, the U.S. government refused to provide any relief”

With the benefit of hindsight, I think it was a mistake not to make greater use of the 421 safeguard provision in the years following China’s WTO entry.** There were surges of imports left and right from 2002 to 2007 (and additional surges in imports of machinery in particular from 2010 to 2014). These surges had a material impact on many manufacturing dependent communities, especially in the American Midwest and Southeast (and in some smaller towns on the west coast that were part of the U.S. tech manufacturing sector). The threat of injury should not have been hard to show.

I also think there was a "421" based option—and an option that was within the agreed accession rules—that could have been used to respond to the initial China shock more effectively. The U.S. could have signaled that so long as China was intervening heavily to hold its currency down, it would be open to a ton of 421 safeguards cases—and hand out real sanctions in response.*** This would not have required Congressional action, nor would it have created a broader precedent that might be used against other countries that intervene to hold their currency down—unlike the various incarnations of the Schumer legislation. Some say that China would never have responded to public pressure on its currency, but I suspect that it would have found a way to shift its policy in the face of real sanctions that hindered China’s ability to export. And politically, the U.S. government would have put itself squarely on the side of those adversely affected by China’s policy of supporting its exports while hindering others’ exports into China.****

(Alternatively, the use of safeguards could have been linked to a request to change policies that were clearly impeding firms from producing outside China for sale inside China, though I personally prefer the currency ask as the main driver of adjustment: currency is market-based, and it doesn’t depend on successfully identifying and changing a ton of China’s domestic policies)

Concluding Thoughts

The initial China shock overlaps with the dollar shock. WTO accession made producing in China for the global market attractive, but did not made China into a great market for manufacturers looking to sell globally produced goods to China. Successful WTO challenges to individual Chinese practices haven’t changed the overall pattern—China’s imports of manufactures for its own use have slid steadily relative to China’s GDP after WTO accession. The more-limited-than-expected gains for manufacturers looking to sell to China though didn’t lead (until now, when the China shock is arguably starting to fade) to a serious reconsideration of the basic gains from China’s asymmetric integration, in part because U.S. and European firms captured many of the initial gains of China’s export success. And some “within the rules” remedies weren’t used as aggressively as they could have been to challenge China’s currency management and other discriminatory practices during the years immediately after China joined the WTO.**

One final note.

There is a huge difference between the 2002-2012 period and now. China’s currency was clearly under pressure to appreciate during most of that period, so letting the currency appreciate was the obvious option for bringing China’s trade into greater balance (the empirical evidence here is actually quite clear, Chinese exports and its trade balance respond as one would expect to changes in the real exchange rate).

China is a more difficult problem, at least intellectually, now than then. There is a plausible argument that—if capital controls are lifted and if China’s system of social insurance remains miserly so savings remains high—the natural market outcome is for China to export more savings and even more goods than it does now to the world. Fighting China’s intervention is in some ways fighting the last war. The correct fight right now is against the domestic policies that keep China’s savings so high, against a surge in capital outflows that leads to a yuan depreciation that then becomes entrenched (if China’s currency goes down, I worry it won’t go back up), and against Chinese import-substituting industrial policies that aim to displace major exports to China. Aircraft and semiconductors come to mind, but there are no doubt others (medical equipment?).***** China’s import-substituting industrial policy aims are at odds with a world that needs more Chinese imports (and less Chinese savings) to be in better balance.

Note: Edited to remove a few type-os subsequent to posting.

* For more on China’s policy of import substitution on high speed rail, see the FT’s Jamil Anderlini, a few years back: "these companies have spent years ‘transferring’, or selling, technology to state-backed partners in exchange for market access—only to be rewarded with shrinking market share in China as a result of state policies that favour local industry. Now these companies find their high-speed technology has been “digested”—defined by the government as a multistep process of buying foreign technology, innovating on that existing platform then selling it under a domestic brand—by former Chinese partners. Furthermore, the foreigners find themselves competing head-to-head for tenders all over the world with Chinese companies selling digested high-speed technology at discount prices, often with cheap state bank financing thrown in." For more on import substitution on wind, see McKinsey’s Orr: "The wind turbine market in China is a clear example of the virtuous (for China) cycle that China’s industrial policy is sometimes able to deliver. Government-owned generators are the core customer for the turbines. They receive subsidies from the government for installing these turbines. The size of the market in China quickly grows to become the largest in the world. Government policy skews the market towards Chinese producers."

** I am well aware of the argument that the tires safeguard raised import prices and hurt consumers, while doing more to raise tire production in Thailand, Malaysia, Indonesia, and Taiwan than in the U.S.. I also suspect that if anyone looked closely, they would find that China’s counter-sanctions on U.S. chicken feet exports were less effective than the U.S. tariffs on tires. Someone should look closely at the data on chicken parts trade through Hong Kong in 2009 and 2010—trade spats are so glamorous. I also am aware that negotiating leverage comes in part from the threat of taking actions that have a real impact on the other side, even if that comes at a cost to your own consumers.

*** I am dodging the question of whether this should be done in conjunction with a finding of manipulation. Remember manipulation is just a name. The designation matters less than the combination of sticks and carrots that could be brought to the table. A linkage could have been made between safeguards and currency without a formal designation, or it could have been done subsequent to a designation. The argument against designation is that it would make any appreciation into a loss of face. That argument has to be weighed against the fact that persuasion didn’t deliver much of a shift in China’s currency from 2003 to mid 2007 (the big move against the dollar was from mid 2007 to mid 2008; that one year period now accounts for about half of the cumulative appreciation from 2001 to 2016). I also am setting aside the option of using counter-vailing duties to combat currency undervaluation (or to counter the effects of intervention more specifically) in order to highlight the scope for using a “within the agreed rules” option. I personally favor well-designed counter-vailing duties for currency intervention, though only as a back-up if counter-intervention doesn’t work – but that is a topic for another time.

**** 421 safeguards also could have been used more aggressively in the early part of the Obama administration, though the case isn’t as clear as it was in the 2003 to 2007 period, as there weren’t quite as many import “surges” after the crisis—and the fact that the provision was set to expire in 2013 reduced interest in the remedy.

***** China is within its WTO rights to levy a 25 percent tariff on imported autos, but I think the high tariff here -- in a sector where China actually imports significant sums from the rest of the world -- ought to get a bit more attention. If China wants to be global trade leader, it could unilaterally bring its tariffs down to world levels. The EU’s tariff on autos is relatively high, but at 10 percent, it is well below China’s tariff.

Online Store

Online Store