Is Bernanke Right on QE3 and the Mortgage Market?

More on:

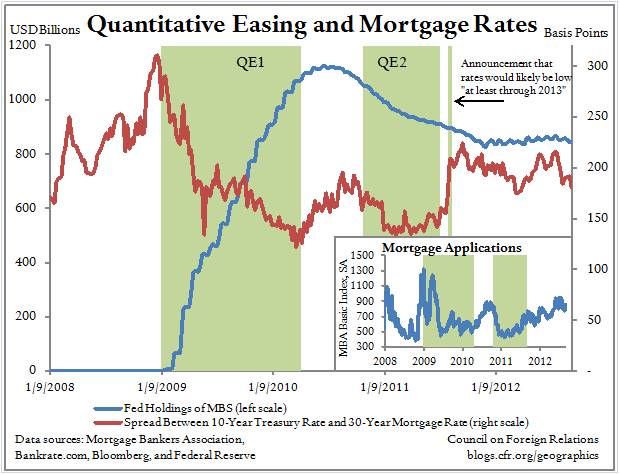

Fed Chairman Ben Bernanke defended QE3 at his September 13 press conference by arguing that it would lower mortgage rates and increase home prices. Over 80% of U.S. household debt is mortgage debt, so the extent to which he is right could be of considerable consequence to the future path of economic recovery. Among the skeptics is the Financial Times, whose lead story on September 17 emphasized processing backlogs at major mortgage originators, which would block the transmission mechanism from Fed mortgage-backed securities (MBS) purchases through to lower mortgage rates. Yet just after the announcement of QE1 in November 2008, which committed the Fed to buying $500 billion in MBS (expanded to $1.25 trillion the following March), mortgage and refinancing applications spiked to much higher levels than they’re at today – and the spread between 10-year Treasurys and 30-year mortgages still fell rapidly and massively, as the graphic above shows. Bernanke has history on his side here.

Financial Times: QE3 Hit by Mortgage Processing Delays

Video: Ben Bernanke's September 13 Press Conference

Steil and Walker: Bernanke's "Risk-On, Risk-Off" Monetary Policy

Eavis: An Enigma in the Mortgage Markets That Elevates Rates

More on:

Online Store

Online Store