More on:

Alan Berube and Joseph Parilla at the Brookings Institution recently published a report on the impressive amount of North American regional trade (with a great interactive that traces exports and imports across the continent). U.S. cities send and receive over $500 billion in goods from Mexican and Canadian cities—out of a total $1.1 trillion in intra-regional trade in 2012. The vast majority (some 69 percent) of this trade is in advanced industries (aerospace, automotive, electronics, machinery, pharmaceuticals, and precision instruments), an economic bright spot in the recovering U.S. economy. Here is a quick look at just how vital the United States’ regional trading ties are for its economic strength and competitiveness.

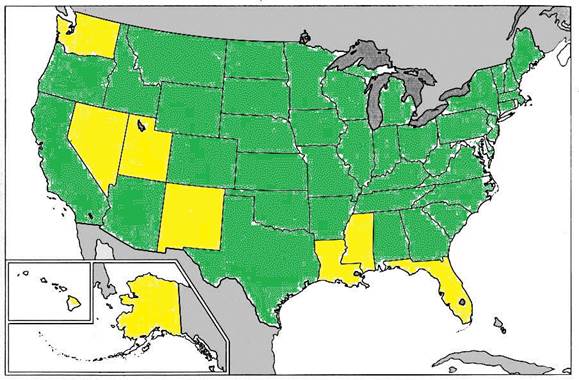

When many Americans think of U.S.-Mexico and U.S.-Canada trade, border states are often what come to mind first. While it is true that Texas, Michigan, and California pulled in some of the biggest trading numbers (with combined regional exports and imports of $463 billion), this is only part of the story. Some forty-one U.S. states have Mexico or Canada as their number one export destination, stretching far across the American heartland (all of the green states in the map below) and supporting some 14 million jobs. Only the nine yellow states have a primary export destination somewhere outside of the region.

Much of the trade moves along the region’s robust supply chains, which stretch from Querétaro to Detroit to Windsor. On average 40 percent of the value of U.S. imports from Mexico and 25 percent of those from Canada actually come from the United States, compared to imports from the rest of the world where U.S. input is closer to 4 percent. This means that of the $277 billion in goods that the United States imported from Mexico in 2012, some $111 billion of the value was created in the United States. This is compared to U.S. imports from China where—despite being a much larger sum of $425 billion—only $17 billion worth of value was made in the United States. In addition, data from the World Trade Organization database reveals that 72 percent of automotive part exports, 71 percent of clothing exports, 55 percent of textile exports, and 58 percent of telecommunications equipment exports stay in the region—meaning the three countries are both making and consuming these products together.

Still, this intra-regional trade as a percent of total trade has been on the decline over the past decade. Though absolute numbers are growing, they are growing more slowly than trade with the rest of the world—reflecting both internal factors, such as U.S. border inefficiencies and higher security costs and external issues, including China’s emergence as a major trading player and Canada and Mexico’s trade diversification. As we look forward, efforts to reverse this trend and re-strengthen continental supply chains will be crucial for pushing the United States’ economy back on its feet, as these numbers show how important the United States neighbors are and will be for its prosperity.

More on:

Online Store

Online Store