The New Geo-Graphics iPad Mini Index Should Calm Talk of Currency Wars

More on:

The “law of one price” holds that identical goods should trade for the same price in an efficient market. To what extent does it hold internationally?

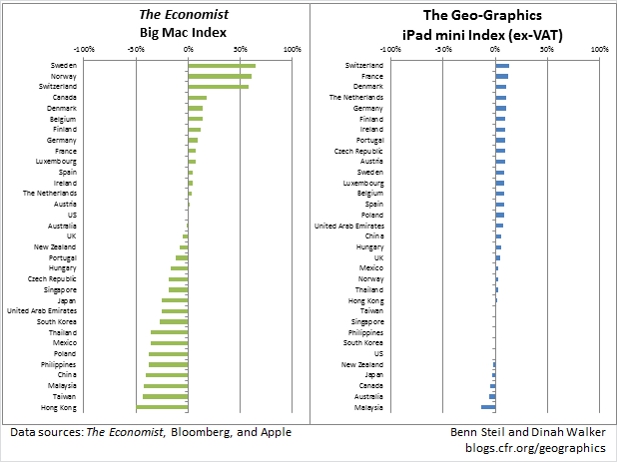

The Economist magazine’s famous Big Mac Index uses the price of McDonalds’ burgers around the world, expressed in a common currency (U.S. dollars), to estimate the extent to which various currencies are over- or under-valued. The Big Mac is a global product, identical across borders, which makes it an interesting one for this purpose. Yet it travels badly – cross-border flows of burgers won’t align their prices internationally.

We’ve created our own index which better meets the condition that the product can flow quickly and cheaply across borders: meet the new Geo-Graphics iPad mini Index.

The iPad mini is a global product that travels by plane in a coat pocket, unlike a burger, and its manufacturer, Apple, is highly attuned to shifting currency values. “We made some pricing adjustments due to changes in foreign exchange rates,” Apple spokesman Takashi Tabayashi told Bloomberg News after Apple raised Japanese iPad prices 15% in May, offsetting the early effect of Abenomics on the yen.

As this week’s Geo-Graphic shows, there are no major violations of the law of one price in the global market for iPad minis – unlike the market for Big Macs. This is particularly the case after stripping out Value-Added Tax distortions. (Sales tax in many countries, like the United States, is not included in the sales price Apple advertises, but VAT is included in such prices for VAT-levying countries. VAT is also at least partly refundable for foreigners exporting the product.)

The Geo-Graphics iPad mini Index confirms that the Swiss franc is a bit overvalued, and the Malaysian ringgit undervalued, but the scale of the misvaluation is much less than the Big Mac index suggests.

In China, an iPad mini now sells for 5.6% more, ex-VAT, in dollar terms than it does in the U.S.. This suggests that the RMB may be closer to its “correct” level than Big Macs, and numerous pundits, suggest.

Currency warriors, take heed – the new Geo-Graphics iPad mini Index, at least, says that you can’t win.

We thank Andrew Henderson for his contribution to this post.

Pakko and Pollard: Burgernomics

Financial Times: Apple Raises Prices As Abenomics Bites Japanese Consumers

Geo-Graphics: Beware Friendly Fire in the Currency Wars

Follow Benn on Twitter: @BennSteil

More on:

Online Store

Online Store