Labor Data Show That China Is a Bubble Waiting to Burst

More on:

China “may have” overinvested to the tune of 12-20% of gross domestic product (GDP) between 2007 and 2011 – this is the diplomatically worded conclusion of a working paper released last week by the IMF. This week’s Geo-Graphic backs it up.

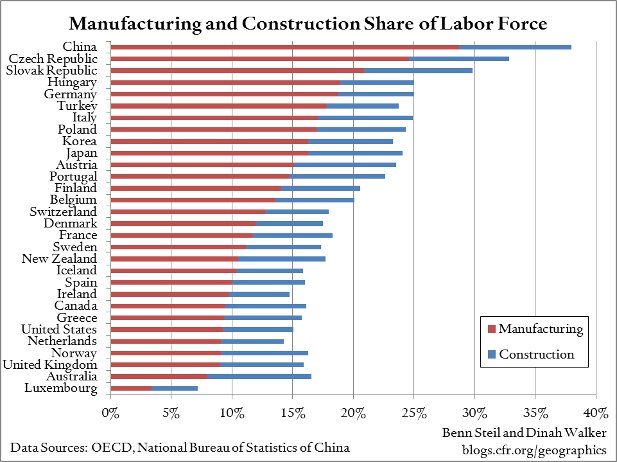

As our figure above shows, the share of the Chinese labor force working in manufacturing and construction, at 38%, is roughly twice the global average – towering well above manufacturing powerhouses like Germany (25%) and South Korea (23%). Manufacturing’s share of the Chinese work force, at 29%, is also 6 percentage points higher than the level at which other fast growing economies have typically begun slowing. Once that share exceeds 23%, according to analysis by Barry Eichengreen, it “becomes necessary to shift workers into services, where productivity growth is slower.” Construction’s share of the Chinese labor force, at 9%, is also 2 percentage points higher than in the United States at the peak of the housing bubble in September 2006. Labor data therefore suggest that China is headed for an extended slowdown in GDP growth.

IMF: Is China Over-Investing and Does It Matter?

Eichengreen, Park, and Shin: When Fast-Growing Economies Slow Down

Orszag: China’s New Leaders Face an Economic Turning Point

Mallaby: Beware Membership of This Elite Club

More on:

Online Store

Online Store