Bank Valuations Tank as ECB Flubs Its Stress Test

More on:

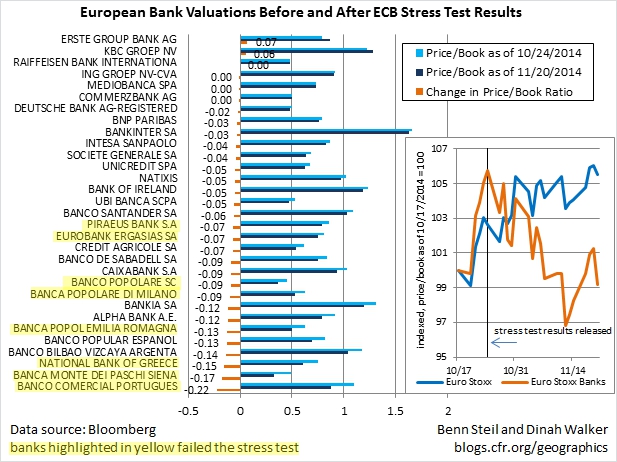

Low market valuations (i.e., price to book ratios) for euro area banks reflect market concerns over their capital cushions, opined the Bank of England just prior to last-year’s launch of the ECB stress tests—the long-awaited results of which were published on October 26. The tests, “by improving transparency,” said the BoE, have “the potential to improve confidence in euro area banks.”

So did they?

We looked at market valuations just before and after publication of the test results. As can be seen from the right-hand figure above, they rose sharply, both in absolute terms and relative to the broader market, in the week leading up to publication—a period in which there was considerable speculation that the results would be good. They were indeed good, with only 25 out of 130 banks failing, but valuations plummeted over the three weeks following publication, in absolute terms and relative to the broader market. 28 of the 31 Euro Stoxx index banks tested now trade at lower valuations than they did before the results were released.

Over that three-week period, independent analyses were steadily coming out—among them, ours—criticizing the tests for flaws such as inflated inflation assumptions and over-generous treatment of deferred tax assets as capital. The ECB’s conclusion that the banks needed to raise a mere €9.5 billion in additional capital was thus not credible, and indeed fell way short of what independent analysts were suggesting.

In sum, the ECB has indeed improved transparency, revealing through data publication just how weak the capital base of the euro area banking sector actually is. But in its unwillingness to call a spade a spade and to do something about it, it has failed to “improve confidence in euro area banks,” as the BoE had hoped it would. The reason may lie in the fact that public-sector funds are needed but may not necessarily be made available by those that have them—a problem we flagged back in March.

The ECB’s failed stress tests thus enter into the euro area’s already crowded stress test Hall of Shame.

Follow Benn on Twitter: @BennSteil

Follow Geo-Graphics on Twitter: @CFR_GeoGraphics

Read about Benn’s latest award-winning book, The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order, which the Financial Times has called “a triumph of economic and diplomatic history.”

More on:

Online Store

Online Store