What Are Economic Sanctions?

- Sanctions have become one of the most favored tools for governments to respond to foreign policy challenges.

- Sanctions can include travel bans, asset freezes, arms embargoes, and trade restrictions.

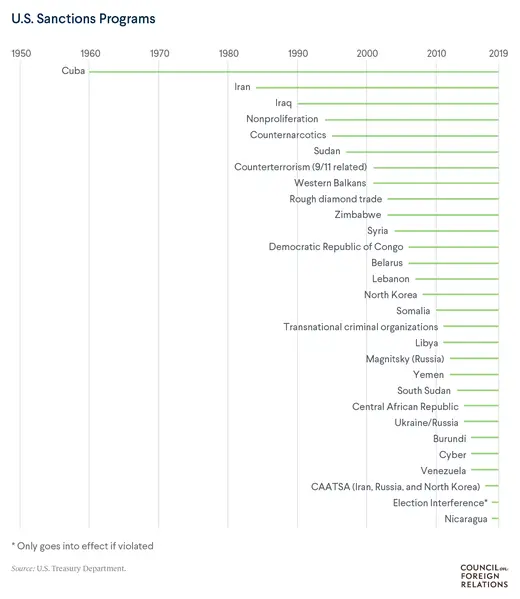

- The United States has more than two dozen sanctions regimes: some target specific countries such as Cuba and Iran, others are aimed at curbing activities including terrorism and drug trafficking.

Governments and multinational bodies impose economic sanctions to try to alter the strategic decisions of state and nonstate actors that threaten their interests or violate international norms of behavior. Critics say sanctions are often poorly conceived and rarely successful in changing a target’s conduct, while supporters contend they have become more effective in recent years and remain an essential foreign policy tool. Sanctions have been the defining feature of the Western response to several geopolitical challenges, including North Korea’s nuclear program and Russia’s intervention in Ukraine. In recent years, the United States has expanded the use of sanctions, applying them and ramping them up against adversaries in Iran, Russia, Syria, and Venezuela.

What are economic sanctions?

Economic sanctions are defined as the withdrawal of customary trade and financial relations for foreign- and security-policy purposes. Sanctions may be comprehensive, prohibiting commercial activity with regard to an entire country, like the long-standing U.S. embargo of Cuba, or they may be targeted, blocking transactions by and with particular businesses, groups, or individuals.

More on:

Since 9/11, there has been a pronounced shift toward targeted or so-called smart sanctions, which aim to minimize the suffering of innocent civilians. Sanctions take a variety of forms, including travel bans, asset freezes, arms embargoes, capital restraints, foreign aid reductions, and trade restrictions. (General export controls [PDF], which are not punitive, are often excluded from sanctions discussions.)

When are sanctions used?

National governments and international bodies such as the United Nations and European Union have imposed economic sanctions to coerce, deter, punish, or shame entities that endanger their interests or violate international norms of behavior. Sanctions have been used to advance a range of foreign policy goals, including counterterrorism, counternarcotics, nonproliferation, democracy and human rights promotion, conflict resolution, and cybersecurity.

Sanctions, while a form of intervention, are generally viewed as a lower-cost, lower-risk course of action between diplomacy and war. Policymakers may consider sanctions as a response to foreign crises in which the national interest is less than vital or where military action is not feasible. Leaders have, on occasion, issued sanctions while they evaluated more punitive action. For example, the UN Security Council imposed comprehensive sanctions against Iraq just four days after Saddam Hussein’s invasion of Kuwait in August 1990. The Security Council did not authorize the use of military force until months later.

What is the sanctions process at the UN?

As the UN’s principal crisis-management body, the Security Council may respond to global threats by cutting economic ties with state and nonstate groups. Sanctions resolutions must pass the fifteen-member council by a majority vote and without a veto from any of the five permanent members: the United States, China, France, Russia, and the United Kingdom. The most common types of UN sanctions, which are binding for all member states, are asset freezes, travel bans, and arms embargoes.

UN sanctions regimes are typically managed by a special committee and a monitoring group. The global police agency Interpol assists some sanctions committees, particularly those concerning al-Qaeda and the Taliban, but the UN has no independent means of enforcement and relies on member states, many of which have limited resources and little political incentive to prosecute noncompliance. Anecdotal evidence suggests that enforcement of UN sanctions is often weak.

More on:

Prior to 1990, the council imposed sanctions against just two states: Southern Rhodesia (1966) and South Africa (1977). However, since the end of the Cold War, the body has used sanctions more than twenty times, most often targeting parties to an intrastate conflict, as in Somalia, Liberia, and Yugoslavia in the 1990s. But despite this cooperation, sanctions are often divisive, reflecting the competing interests of world powers. For instance, since 2011, Russia and China have vetoed several Security Council resolutions concerning the conflict in Syria, some of which could have led to sanctions against President Bashar al-Assad’s regime.

What is the sanctions process in the EU?

The European Union imposes sanctions (known more commonly in the twenty-eight-member bloc as restrictive measures [PDF]) as part of its Common Foreign and Security Policy. Because the EU lacks a joint military force, many European leaders consider sanctions the bloc’s most powerful foreign policy tool. Sanctions policies must receive unanimous consent from member states in the Council of the European Union, the body that represents EU leaders.

Since its inception in 1992, the EU has levied sanctions more than thirty times (in addition to those mandated by the UN). Analysts say the comprehensive sanctions the bloc imposed on Iran in 2012—which it later lifted in 2015 as part of the nuclear agreement—marked a turning point for the EU, which had previously sought to limit sanctions to specific individuals or companies.

Individual EU states may also impose harsher sanctions independently within their national jurisdiction.

What is the sanctions process in the United States?

The United States uses economic and financial sanctions more than any other country. Sanctions policy may originate in either the executive or legislative branch. Presidents typically launch the process by issuing an executive order (EO) that declares a national emergency in response to an “unusual and extraordinary” foreign threat, for example, “the proliferation of nuclear, biological, and chemical weapons” (EO 12938 [PDF]) or “the actions and policies of the Government of the Russian Federation with respect to Ukraine” (EO 13661 [PDF]). This affords the president special powers (pursuant to the International Emergency Economic Powers Act [PDF]) to regulate commerce with regard to that threat for a period of one year, unless extended by the president or terminated by a joint resolution of Congress. (Executive orders may also modify sanctions.)

Notably, most of the more than fifty states of emergency declared since Congress placed limits on their duration [PDF] in 1976 remain in effect today, including the first, ordered by President Jimmy Carter in 1979 with respect to Iran.

Congress, for its part, may pass legislation imposing new sanctions or modifying existing ones, which it has done in many cases. In instances where there are multiple legal authorities, as with Cuba and Iran, congressional and executive action may be required to alter or lift the restrictions. Sometimes the two branches clash on sanctions policy. For instance, in July 2017, Congress passed and President Donald J. Trump reluctantly signed a bill imposing new sanctions on Russia for interfering in the previous U.S. presidential election. The bill, which controversially placed limits on Trump’s ability to lift the Russia sanctions, passed with veto-proof majorities.

The more than two dozen existing U.S. sanctions programs are administered by the Treasury Department’s Office of Foreign Assets Control (OFAC), while other departments, including State, Commerce, Homeland Security, and Justice, may also play an integral role. For instance, the secretary of state can designate a group a foreign terrorist organization or label a country a state sponsor of terrorism, both of which have sanctions implications. (Travel bans are handled by the State Department as well.) State and local authorities, particularly in New York, may also contribute to enforcement efforts.

In 2019, the United States had comprehensive sanctions regimes on Cuba, North Korea, Iran, Sudan, and Syria, as well as more than a dozen other programs targeting individuals and entities pertaining to certain political crises or certain types of suspected criminal behavior, such as narcotics trafficking. OFAC routinely adds (and deletes) entries on its blacklist of more than six thousand individuals, businesses, and groups (collectively known as specially designated nationals, or SDNs.) The assets of those listed are blocked, and U.S. persons, including U.S. businesses and their foreign branches, are forbidden from transacting with them. Under President Trump, OFAC has designated several high-ranking individuals and politically connected firms from Cuba, Myanmar, Nicaragua, and Venezuela. The agency has also recently drawn attention for removing some companies controlled by Russian oligarchs from the SDN list.

How did the 9/11 attacks change sanctions policy?

In concert with its allies, the U.S. government launched an all-out effort to disrupt the financial infrastructure supporting terrorists and international criminals. This campaign focused on the gateways of the global financial system—international banks—and relied on a handful of new authorities granted to U.S. agents in the days after the attacks.

On September 23, President George W. Bush signed EO 13224 [PDF], which provided Treasury Department officials with far-reaching authority to freeze the assets and financial transactions of individuals and other entities suspected of supporting terrorism. Weeks later, Bush gave the Treasury broad powers (under section 311 of the USA Patriot Act) to designate foreign jurisdictions and financial institutions as “primary money laundering concerns.” (Notably, Treasury needs only a reasonable suspicion—not necessarily any evidence—to target entities under these laws.)

Experts say that these measures fundamentally reshaped the financial regulatory environment, greatly raising the risks for banks and other institutions engaged in suspicious activity, even unwittingly. The centrality of New York and the dollar to the global financial system means these U.S. policies are felt globally.

Penalties for sanctions violations can be huge in terms of fines, loss of business, and reputational damage. Federal and state authorities have been particularly rigorous in prosecuting banks in recent years, settling at least fifteen cases with fines over $100 million since 2009. In a record settlement, France’s largest lender, BNP Paribas, pleaded guilty in 2014 to processing billions of dollars for blacklisted Cuban, Iranian, and Sudanese entities. The bank was fined nearly $9 billion—by far the largest such penalty in history—and lost the right to convert foreign currency into dollars for certain types of transactions for one year.

Similarly, those tainted by a U.S. money-laundering designation may suffer crippling losses. In September 2005, Treasury officials labeled Banco Delta Asia (BDA) a primary money-laundering concern, alleging that the Macau-based bank was a “willing pawn for the North Korean government.” Within a week, customers withdrew $133 million, or 34 percent of BDA’s deposits. The financial shock rippled across the globe, inducing other international banks to sever ties with Pyongyang.

“This new approach worked by focusing squarely on the behavior of financial institutions rather than on the classic sanctions framework of the past,” wrote Juan Zarate, a top Bush administration official involved in counterterrorism efforts, in his book Treasury’s War (2013). “In this new approach, the policy decisions of government are not nearly as persuasive as the risk-based compliance calculus of financial institutions.”

What are extraterritorial sanctions?

Traditionally, sanctions prohibit only a country or region’s corporations and citizens from doing business with a blacklisted entity (unlike UN sanctions, which are global by nature). However, extraterritorial sanctions (sometimes called secondary sanctions or a secondary boycott) are designed to restrict the economic activity of governments, businesses, and nationals of third countries. As a result, many governments consider these sanctions a violation of their sovereignty and of international law.

In recent years, the reach of U.S. sanctions has continued to draw the ire of some close allies. France’s leadership criticized the U.S. prosecution of BNP Paribas as “unfair” and indicated there would be “negative consequences” for bilateral as well as U.S.-EU relations. “The extraterritoriality of American standards, linked to the use of the dollar, should drive Europe to mobilize itself to advance the use of the euro as a currency for international trade,” said French Finance Minister Michel Sapin.

Such frustrations peaked after the United States withdrew from the 2015 Joint Comprehensive Plan of Action and promised to reinstate extraterritorial sanctions on European firms that did business with Iran. In response, the EU announced the creation of a “special purpose vehicle” that would, in theory, allow European companies to trade with Iranian counterparts and circumvent the U.S. sanctions regime. However, most view the workaround, known as Instex, as a merely diplomatic gesture.

Do sanctions work?

Many scholars and practitioners say that sanctions, particularly targeted sanctions, can be at least partly successful and should remain in the tool kits of foreign policy–makers. Evaluations of sanctions should consider the following:

- The dynamics of each historical case vary immensely. Sanctions that are effective in one setting may fail in another, depending on countless factors. Sanctions programs with relatively limited objectives are generally more likely to succeed than those with major political ambitions. Furthermore, sanctions may achieve their desired economic effect but fail to change behavior. UN sanctions on Afghanistan in 2000 and 2001 exacted a heavy toll but fell short of moving the Taliban regime to surrender Osama bin Laden.

- Sanctions often evolve over time. A classic illustration of this is the U.S. regime on Iran. Except for a brief period in the 1980s, Washington has had sanctions on Tehran since U.S. hostages were taken in 1979. However, the scope of these measures and the logic behind them have changed dramatically.

- Only correlations, not causal relationships, can be determined. For example, many believe UN sanctions imposed on Liberia in 2003 helped bring about the collapse of the Charles Taylor regime, but any number of domestic and international factors could have played more decisive roles.

- The comparative utility of sanctions is what matters, not simply whether they have achieved their objective. U.S.-EU sanctions against Russia may not have ended the crisis in Ukraine, but other courses of action, including inaction, may have fared worse (and cost more). In some cases, sanctions may simply be intended as an expression of opprobrium.

Meanwhile, experts cite several best practices in developing sanctions policy:

- Develop a well-rounded approach. An effective strategy often links punitive measures, such as sanctions and the threat of military action, with positive inducements, such as financial aid. Some analysts point to the Libya strategy adopted by the United States and its allies in the late 1990s and early 2000s as a good example.

- Set attainable goals. Sanctions aimed at regime change or that offer the target government little recourse except what it believes would be political suicide are likely to fail. Many experts cite the U.S. embargo on the Castro regime as a cautionary tale.

- Build multilateral support. The more governments that sign on to (and enforce) sanctions the better, especially in cases where the target is economically diversified. Sanctions against South Africa’s apartheid regime in the 1980s, Saddam Hussein’s Iraq in the 1990s, or on Iran and Russia today would not be nearly as powerful without multilateral support.

- Be credible and flexible. The target must believe that sanctions will be increased or reduced based on its behavior. In 2012, the Obama administration responded to major political reforms in Myanmar by easing some financial and investment restrictions. It ended the sanctions program in 2016. In this case, however, Myanmar’s leaders soon ramped up abuses against their country’s Rohingya minority, and the United States reimposed sanctions in early 2019.

Looking ahead, some experts warn that sanctions should be viewed as a double-edged sword, one that can help the United States achieve policy goals in the short term but, if used carelessly, may put the country’s financial leverage at risk in the long run. Former Treasury Secretary Jacob J. Lew and former State Department official Richard Nephew write that “today, the country largely gets its way because there is no alternative to the dollar and no export market as attractive as the United States. But if Washington continues to force other nations to go along with policies that they consider both illegal and unwise, over the next 20 to 30 years, they are likely to shift away from the United States’ economy and financial system.”

Andrew Chatzky contributed to this report.

Recommended Resources

This study by Security Council Report, an independent nonprofit, provides an explanatory guide on the fundamentals of UN sanctions [PDF].

This paper from the EU Non-Proliferation Consortium examines the effectiveness of the bloc’s sanctions policy, using Iran as a case study.

In Treasury’s War, former senior Bush administration official Juan Zarate pens a definitive account of how “financial warfare” developed into a major component of U.S. foreign policy following the 9/11 attacks.

Online Store

Online Store